Responding to the WBTC de-peg in the wake of the FTX-Alameda Research collapse

The FNDX 100 index strategy holds its Bitcoin (BTC) allocation in the form of the WBTC token, Wrapped Bitcoin.

This is an ERC-20 (Ethereum) token whose value is pegged to Bitcoin. The WBTC token maintains this peg because it is backed 1:1 by reserves (more on this mechanism later), and it is one of the largest tokens by market cap in its own right.

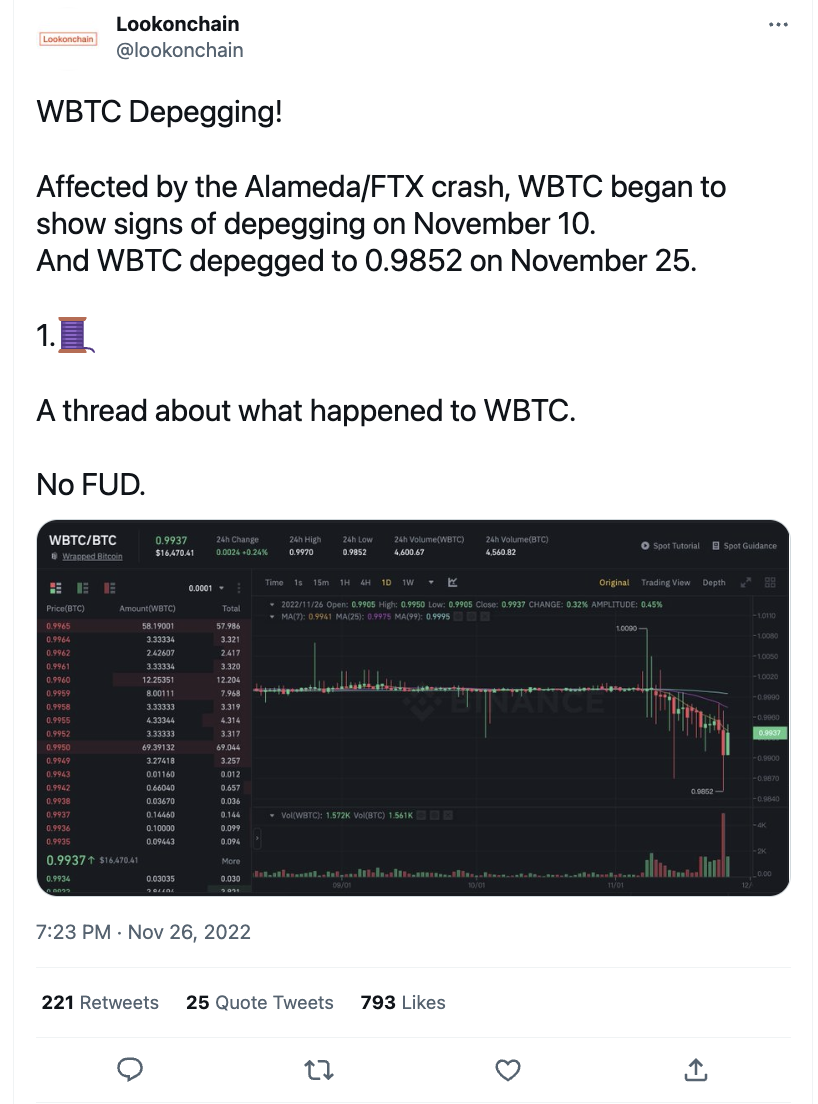

On Saturday 26 November, the WBTC price sharply de-coupled from BTC. For a short period of time, a WBTC was worth 0.98 BTC, and FNDX responded. These are the details of the event and of FNDX’s response.

FNDX had been observing the price of 1 WBTC slip from approximately 1 BTC to very slightly lower levels since 9 November, following the crisis brought about by FTX. This is the ratio of WBTC to BTC from 1 November up until 26 November (source: CoinMarketCap)

You can see the price hold steady at 1 BTC until 9 November, when, after a period of volatility highlighted in red, the ratio begins to dip. This is the start of the de-peg.

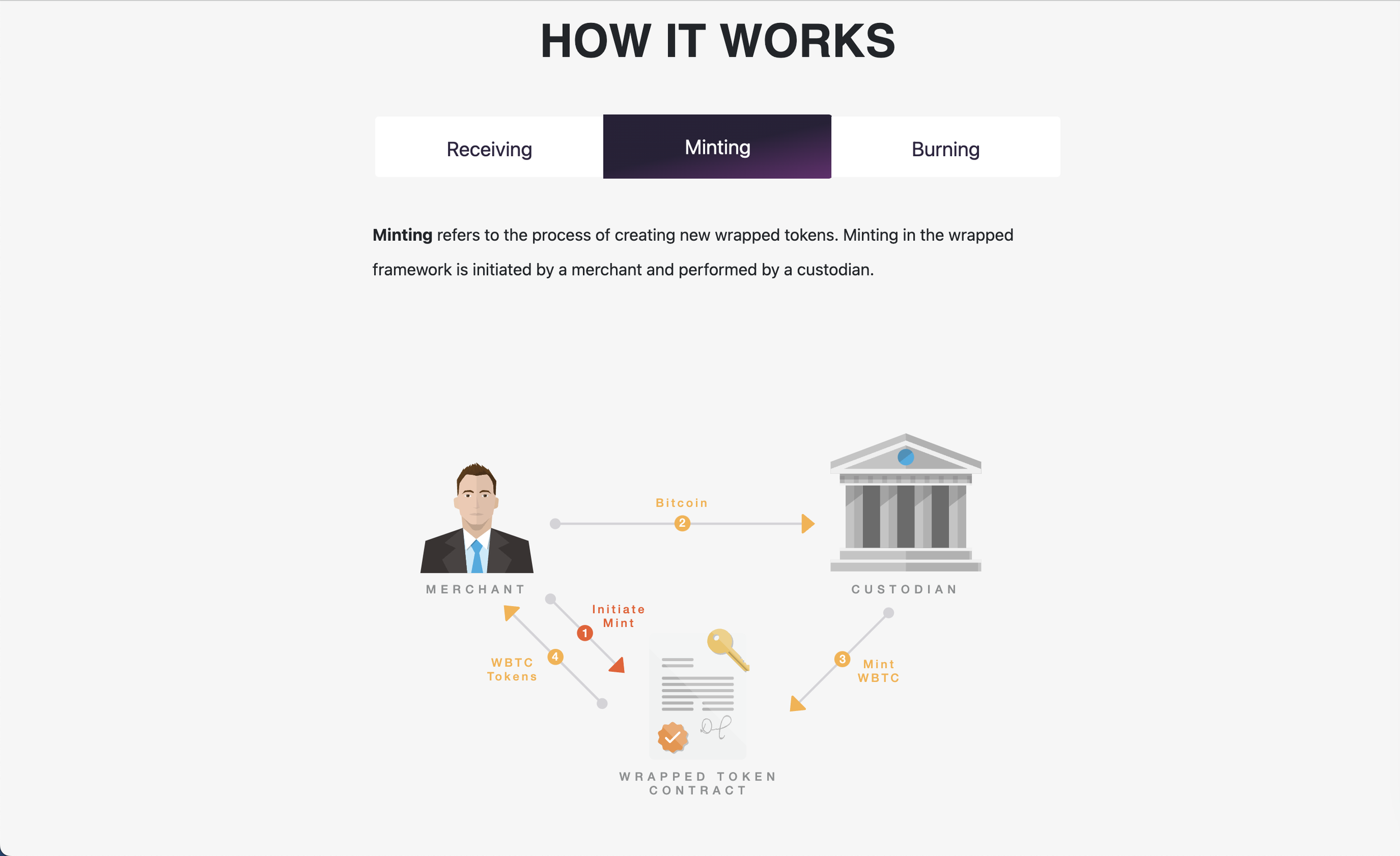

This by itself did not deserve an immediate response - the mechanism of locking up BTC on the Bitcoin blockchain and issuing an equivalent number of WBTC on the Ethereum blockchain is well-known, and centres around the crypto custodian BitGo.

BitGo receives Bitcoin from merchants, custodies it, and directs an Ethereum smart contract to issue new WBTC. Merchants are well-known, named institutions. Everyday WBTC holders interact with merchants or among themselves, not with BitGo.

BitGo has published this list of merchants and, for each, the Bitcoin blockchain address they deposit BTC at and the Ethereum blockchain they receive WBTC in return. Plus the Bitcoin blockchain address they receive Bitcoin back when they send WBTC to the contract to be burnt. The company has also published its Ethereum WBTC and Bitcoin BTC reserves.

On 25 November, an account on Twitter alleged that half of WBTC tokens were 'minted' by the FTX-linked hedge fund Alameda Research that had filed for bankruptcy, and urged their followers to 'bail' on WBTC.

On the same day, an on-chain intelligence firm tweeted that Alameda withdrew large amounts of tokens from its wallets on FTX US just before the FTX collapse, of which about 19% was WBTC. That WBTC was then sent to BitGo and converted back to BTC.

It is likely that the panic around this led to a sharp fall in the price of WBTC relative to BTC shortly afterwards on 26 November as people began to sell their WBTC on centralised and decentralised exchanges. CoinMarketCap also shows a large sustained increase in trading volume (the grey hump at the bottom right) around the time of the de-peg:

This drove the de-peg from 0.998 all the way down to 0.982.

Now. Alameda was a Wrapped Bitcoin merchant. That meant it could send Bitcoin to BitGo and receive WBTC in return, or vice versa (which is what it did just before the FTX collapse). It does not custody Bitcoin, nor can it unilaterally mint or burn WBTC (that is done by the multi-signature contract shared with BitGo and other merchants).

The tweet about Alameda 'minting' half of all WBTC was incorrect in a fundamental way. The reality was that half the Bitcoin sent to BitGo was sent by Alameda, and therefore half the WBTC minted were sent to Alameda's merchant address. The dominance of this one merchant by itself does not affect the integrity of WBTC. Nor does the fact that Alameda sent a large portion of that WBTC back to BitGo, which was burnt by the contract and BTC issued to Alameda.

In fact the WBTC mechanism worked exactly as designed.

Nevertheless, the sharp de-peg on 26 November – unfounded or not – could have risked the integrity of the FNDX 100 strategy and put the value of its holdings at risk. This is why FNDX had to respond.

At 10:30 UTC on 27 November, FNDX 100 swapped the entirety of its WBTC for the USDC stablecoin.

At this time, the peg had already bounced back to about 0.994. However, out of an abundance of caution, FNDX decided to wait out the volatility. The integrity of WBTC remained intact but irrationality still prevailed.

In the meantime, other people on Twitter explained the situation with WBTC and Alameda, in response to the post above.

and finally in an official post by BitGo itself. Crypto publications also brought sanity to the situation. This is a good example:

> Alameda was a lot of things, but a bitcoin protocol hacker they were not, and therefore they did not create bitcoin out of nothing on-chain, nor wBTC.

> We know that because we can see on-chain that the amount of bitcoin are the same as those of wBTC, and therefore yes those bitcoin are real.

> Their ownership as such is therefore irrelevant with practically their owner being BitGo and technically ad abstractium their owner is the network itself which says the bitcoin are there. And if the fiduciary owner is Alameda, then either they sold them or they’re still the owner.

This eventually brought down the de-peg. The WBTC:BTC price ratio has risen steadily from 27 November to the time of this writing, and currently stands at 0.999.

FNDX waited four days – three full days of rising WBTC:BTC price ratio (ie narrowing de-peg) until finally swapping the USDC back to WBTC on 1 December 09:10 UTC.

This came at the cost of a dip in the outperformance of FNDX 100 vs Bitcoin. You can see that FNDX 100 (in blue) missed out on the slight rise in the Bitcoin price (in orange) during those four days.

In summary

FNDX's policy is to preserve the integrity of customer funds above all other factors, whether tracking error or returns, even in cases where the underlying token is sound.

To quote the Intel CEO Andy Grove, only the paranoid survive.

A slight four-day narrowing of outperformance, in FNDX’s view, is well worth it.

★

Photo by Jo Coenen - Studio Dries 2.6 on Unsplash.