Spot vs. Futures ETFs: A Critical Analysis of Retail Crypto Investment Options

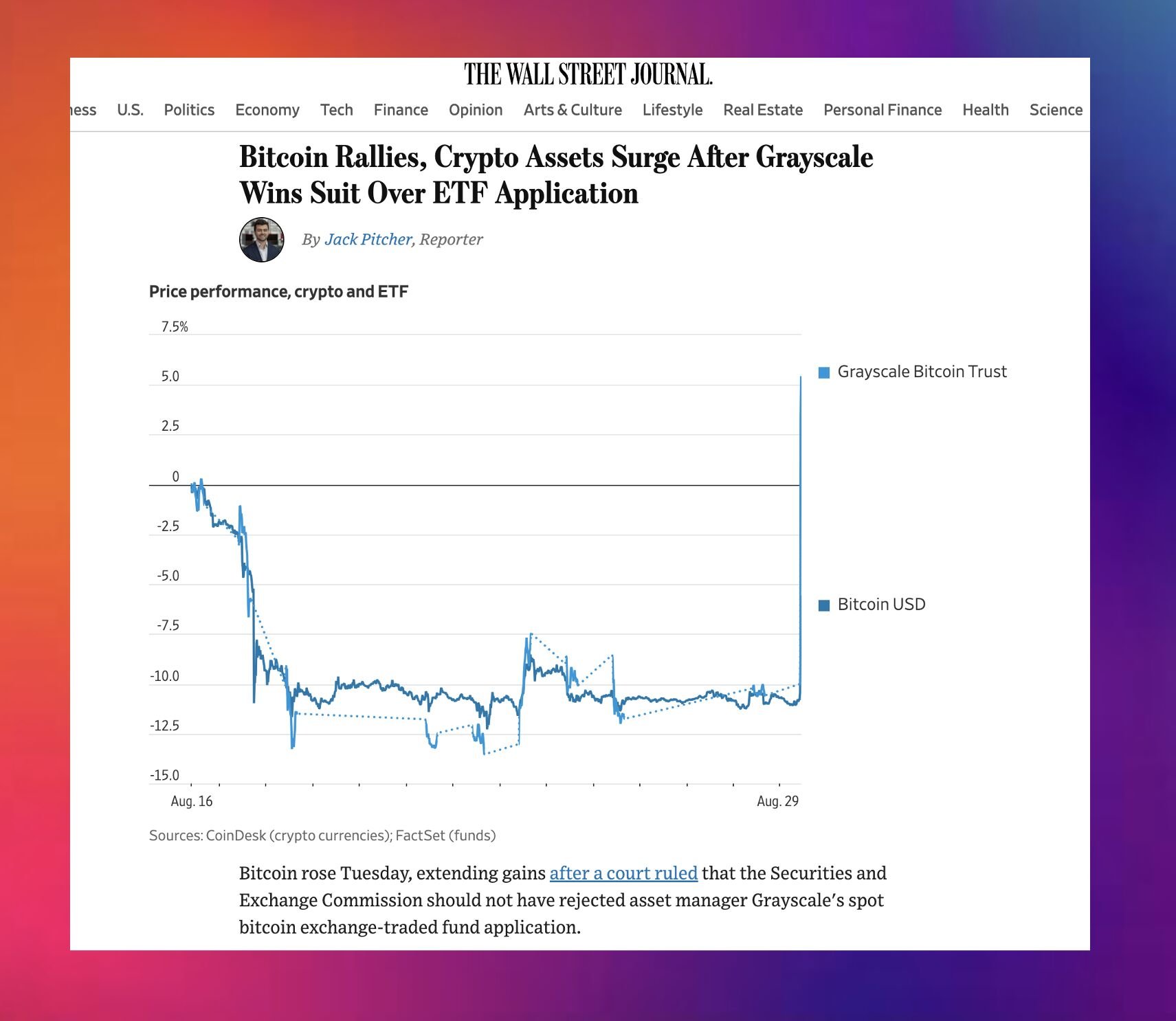

A US appeals court decision ruled that the SEC should not reject a company's spot Bitcoin ETF application. This has led to widespread industry celebration. Maybe we should not be so sure this is a good thing 👇

For most people, futures ETFs are the right choice, instead of spot ETFs which actually hold tokens in custody. The only retail Bitcoin ETF product in the US today is the ProShares Bitcoin Strategy ETF, which holds Bitcoin futures, not actual Bitcoins.

Now -- there is real excitement about spot ETFs in the US for Bitcoin and Ethereum and maybe baskets of tokens in the future.

But most people just want price exposure to BTC and ETH.

What's attractive to them is the potential for extremely high gains over some time frame.

Actually owning tokens is secondary. If they're not holding tokens in a self-custody wallet, there's little difference between some regulated entity holding tokens on their behalf, or them buying a futures instrument from a regulated entity.

Both give this retail investors exposure to crypto. Both need deep, reliable markets.

Futures markets are regulated. The ProShares Bitcoin Futures ETF buys futures from the CME group.

According to the regulator, it could be that if spot ETFs are to be approved, spot markets must be regulated too.

Since Bitcoin (and Ethereum and other tokens) are traded on multiple exchanges globally, the SEC will look for of them must be regulated, including autonomous decentralised ones aka DEXes. In fact there is draft regulation in the US that proposes just this.

Far from being a good thing, this push for regulating all liquidity will have a chilling effect on web3 development and make the move to an open, permissionless, borderless Web3 economy harder.

It will limit Bitcoin and Ethereum and other tokens to being speculative casino chips/trading cards, not the fuel that aligns the incentives of networked participants of decentralised applications.

Surely this is not what the industry wants. I think we should think about second order consequences before cheering one side or another in matters of regulation.

★